What ROI Can Manufacturers Expect from Modern Procurement Transformation?

ROI in industrial procurement has fundamentally changed.

Where procurement was once measured primarily on negotiated price reductions, today’s leading manufacturers evaluate return on investment across cost, speed, resilience, data quality and cross-functional impact.

For companies operating in machining-intensive, drawing-based environments, ROI is no longer a vague promise; it is measurable, trackable and increasingly expected by executive leadership.

This article explores how small, mid-sized, and large manufacturers think about ROI, the role procurement plays in achieving it and how data- and AI-driven sourcing models quietly accelerate results.

Why ROI Expectations in Procurement Are Rising

Across aerospace, automotive, machinery, industrial equipment, and medical manufacturing, procurement is under pressure from multiple sides:

Volatile material and energy prices

Increasing part complexity and customization

Longer RFx cycles and supplier capacity constraints

Executive demand for measurable, repeatable savings

At the same time, organizations have accumulated years of historical purchasing data, CAD models and ERP records; often without the ability to systematically leverage them.

This gap between available data and actionable insight is where modern ROI discussions now start.

ROI by Company Size: How Expectations Differ

Small Industrial Manufacturers (high machining complexity, lean teams)

How they define ROI

Immediate and visible cost savings

Reduction of manual effort in sourcing and quoting

Faster time-to-order for engineering-driven parts

Typical procurement reality

Procurement teams wear multiple hats

Heavy reliance on individual expertise and supplier memory

RFQs and should-costing handled manually or inconsistently

ROI focus areas

5–10% part cost reduction through better benchmarks

30–50% reduction in RFQ cycle time

Faster onboarding of new suppliers without added risk

For these organizations, ROI is often realized quickly by improving cost transparency on drawing-based parts and eliminating repetitive manual work; freeing procurement to focus on negotiation and supplier strategy rather than administration.

Mid-Sized to Large Manufacturers (multi-plant, ERP/PLM maturity)

How they define ROI

Sustainable savings across categories

Scalable procurement processes across regions

Better collaboration between engineering and sourcing

Typical procurement reality

Strong ERP and PLM systems, but fragmented data

Duplicate or near-duplicate parts across plants

Inconsistent pricing for similar components

ROI focus areas

8–15% reduction in addressable component spend

Standardization of parts and drawings

Improved negotiating leverage through data-backed should-costs

Reduction in supplier base complexity

At this level, procurement ROI is structural.

Procurement becomes a value creation function, using data to guide engineering decisions early and reduce downstream sourcing friction.

Large Global Enterprises (global sourcing, executive oversight)

How they define ROI

Enterprise-wide impact with CFO-level visibility

Predictability and governance across sourcing decisions

Long-term cost avoidance

Typical procurement reality

Tens of thousands of drawing-based parts

Multiple ERPs, PLMs, and regional sourcing teams

High exposure to supplier risk and cost variance

ROI focus areas

Double-digit savings on selected categories

Measurable decrease in redundant and duplicate parts

Improved part standardization across engineering and procurement

Shorter sourcing cycles across global plants

Higher percentage of parts with reliable should-cost models

Supplier consolidation without supply risk

For these organizations, ROI must be provable, repeatable, and auditable, often tied directly to transformation initiatives sponsored by the CFO, COO, or CTO.

The Evolving Role of Procurement in ROI Creation

Across all company sizes, one trend is consistent:

Procurement is moving from execution to intelligence.

Modern procurement teams are expected to:

Act as data stewards and data-driven negotiators

Translate engineering complexity into commercial insight

Provide early cost guidance during design before release

This shift requires:

High-quality (cleaned) master data

Access to historical purchasing intelligence

Tools that scale expertise beyond individual buyers

When procurement can answer questions like “What should this part cost?”, “Have we bought something similar before?”, or “Which suppliers are best suited for this geometry?” ROI follows naturally.

Where Data-Driven Procurement Quietly Multiplies ROI

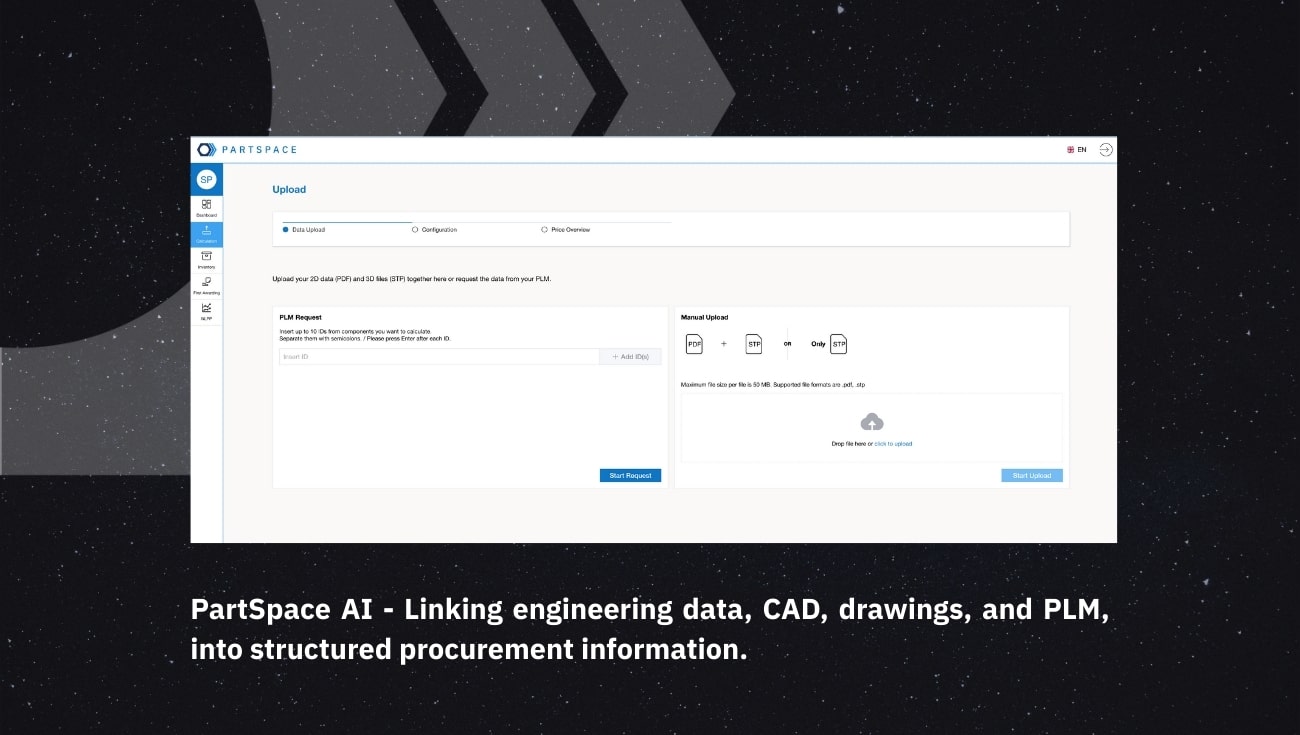

The strongest ROI outcomes increasingly come from organizations that connect:

CAD and drawing data

Historical purchasing records

Supplier performance information

This enables:

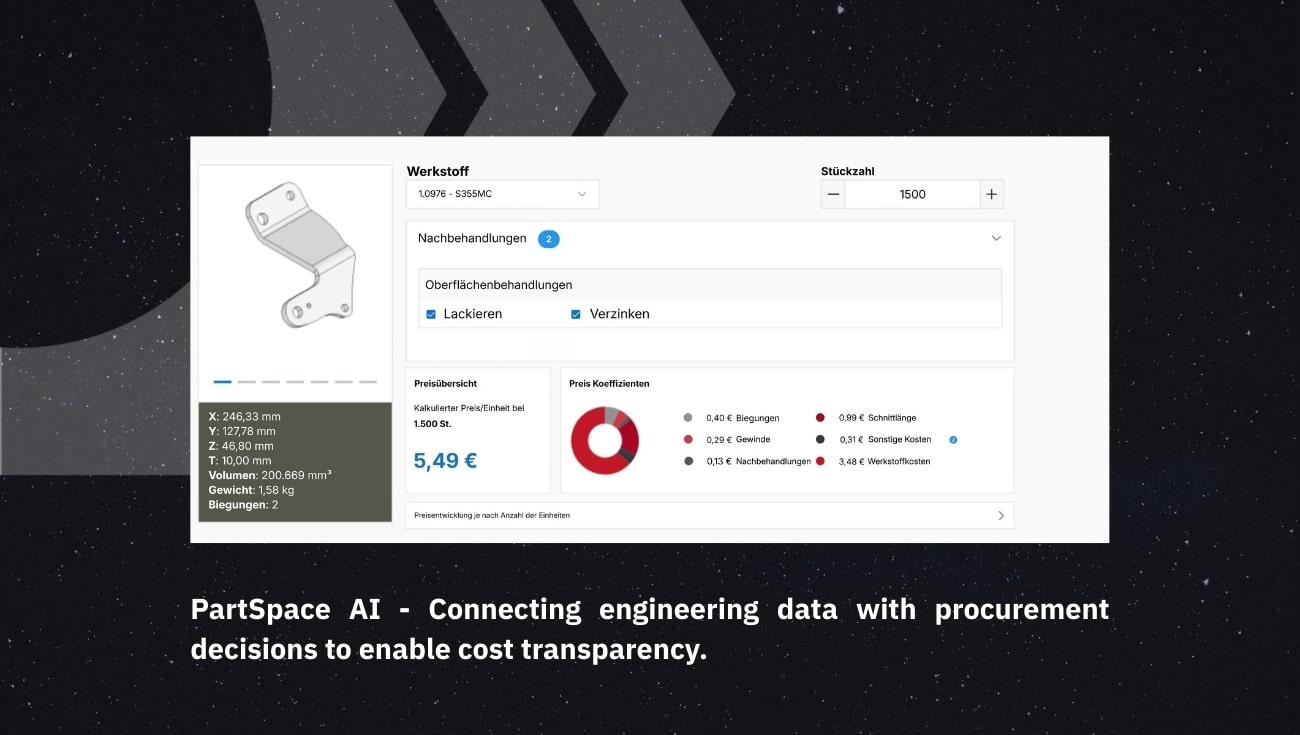

Automated should-costing

Similarity-based part analysis

Faster supplier shortlisting

Data-backed negotiations

Rather than replacing procurement expertise, modern AI-supported platforms amplify it, allowing teams to act faster, with more confidence and across far larger datasets than manual approaches ever allowed.

Solutions like PartSpace AI are often introduced not as disruptive overhauls, but as pragmatic accelerators, quietly turning existing data into measurable results while keeping humans firmly in the loop.

Measuring ROI: Metrics That Matter

Leading industrial organizations track ROI through a combination of:

% reduction in part cost

RFx cycle time reduction

Increase in parts with reliable should-costs

Master-data completeness

Supplier consolidation rates

Engineering-to-procurement handover speed

The most successful teams align these metrics directly with executive priorities—making procurement ROI visible far beyond the sourcing function.

Final Thoughts: ROI Is No Longer Optional

For machining-intensive manufacturers, ROI from procurement transformation is no longer theoretical.

It is expected, measured and increasingly tied to competitive advantage.

Organizations that succeed are not necessarily those with the largest teams, but those that:

Leverage their existing data intelligently

Equip procurement with scalable insight

Align sourcing decisions with engineering reality

In this environment, procurement becomes a strategic engine for sustainable value creation and deliver savings.

How We Connect Your Data to Increase ROI

How We Connect Your Data to Increase ROI

Related Articles

How Engineering Intelligence Improves Procurement Decisions

Engineering data is one of the most underused assets in industrial procurement. In this interview, PartSpace CEO Robert Hilmer explains why procurement decisions increasingly depend on engineering intelligence, how AI can connect technical drawings with purchasing data, and what this means for cost transparency, supplier selection, and smarter sourcing strategies.

How AI reduces costs and complexity in technical purchasing

AI-powered analysis of technical drawings transforms purchasing by enabling transparent cost breakdowns, data-driven price prediction and smarter supplier selection in manufacturing.